If policymakers expand aggregate demand then in the long run – If policymakers expand aggregate demand, the long-run effects can be significant. This paper will explore the potential consequences of sustained aggregate demand expansion on economic growth, inflation, employment, and other key economic indicators. We will also discuss the role of supply-side factors, fiscal and monetary policy tools, and international economic effects in shaping these long-run outcomes.

Economic Growth and Long-Run Effects: If Policymakers Expand Aggregate Demand Then In The Long Run

Expanding aggregate demand in the short term can stimulate economic growth. However, the long-run effects are more nuanced.

Sustained aggregate demand expansion can lead to inflationary pressures as demand exceeds supply. This can erode purchasing power and reduce the real value of savings. Additionally, it can lead to imbalances in the labor market, potentially pushing wages up faster than productivity, which can further fuel inflation.

Fiscal and Monetary Policy Implications

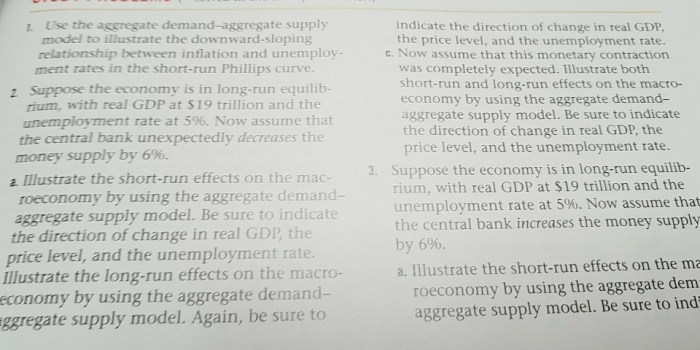

Fiscal policy tools, such as tax cuts or increased government spending, can be used to expand aggregate demand. Monetary policy tools, such as lowering interest rates, can also stimulate demand by making borrowing more attractive.

The effectiveness of these tools depends on the economic context. Fiscal policy is more effective when the economy is operating below capacity, while monetary policy is more effective when inflation is low.

Trade-offs exist between using different policy instruments. Fiscal policy can have long-term budgetary implications, while monetary policy can impact exchange rates and financial stability.

Supply-Side Considerations

Supply-side factors, such as productivity, technological advancements, and labor market dynamics, can influence the long-run impact of aggregate demand expansion.

Productivity gains can increase output without inflationary pressures, while technological advancements can create new products and industries. Labor market policies that enhance skills and mobility can improve the supply of labor and reduce wage pressures.

International Economic Effects

Expanding aggregate demand in one country can have international implications. Increased imports can lead to trade deficits, while currency appreciation can make exports less competitive.

Global economic conditions and exchange rates can also influence the long-run effects. A strong global economy can support demand for exports, while a weak global economy can dampen demand.

International cooperation is crucial to manage aggregate demand and mitigate potential negative spillovers.

Empirical Evidence and Case Studies, If policymakers expand aggregate demand then in the long run

Empirical evidence suggests that sustained aggregate demand expansion can lead to both economic growth and inflationary pressures in the long run.

Case studies of countries that have implemented such policies, such as the United States in the 1960s and Japan in the 1980s, provide valuable lessons on the trade-offs and challenges involved.

Common Queries

What is aggregate demand?

Aggregate demand is the total demand for goods and services in an economy.

What are the potential consequences of expanding aggregate demand?

Expanding aggregate demand can lead to higher economic growth, inflation, and employment in the short run. However, in the long run, the effects are less clear and depend on a variety of factors.

What are the trade-offs associated with using different policy instruments to expand aggregate demand?

Different policy instruments have different costs and benefits. For example, fiscal policy can be more effective than monetary policy in stimulating economic growth, but it can also lead to higher government debt. Monetary policy can be more effective in controlling inflation, but it can also lead to higher interest rates.