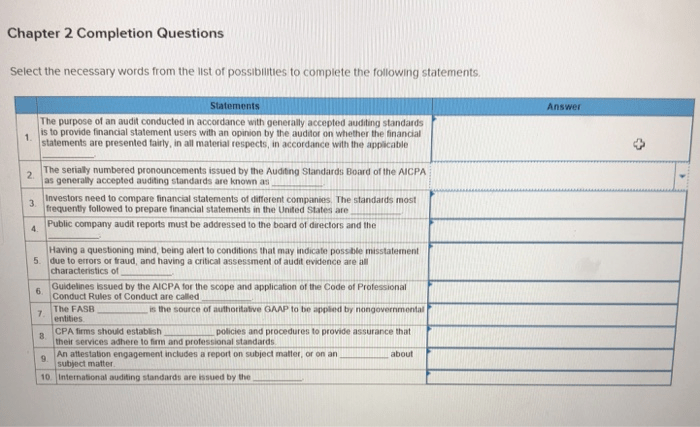

In an attestation engagement a cpa practitioner is engaged to – In an attestation engagement, a CPA practitioner is engaged to provide an opinion on the fairness of financial statements or other subject matter. Attestation engagements are distinct from audit engagements, as they focus on providing a level of assurance that is less than that provided by an audit.

The CPA practitioner’s role in an attestation engagement is to gather evidence and assess the reliability of the subject matter. The practitioner must be independent and objective in order to provide an unbiased opinion.

1. Understanding Attestation Engagements: In An Attestation Engagement A Cpa Practitioner Is Engaged To

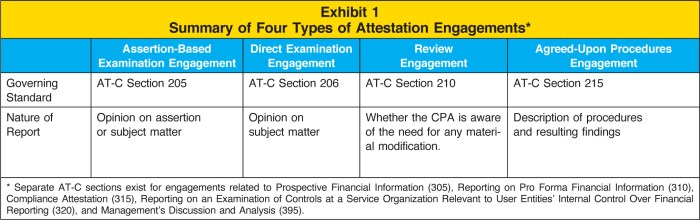

Attestation engagements are professional services performed by a CPA practitioner to provide assurance on the reliability of information.

The purpose of an attestation engagement is to enhance the credibility of information by providing an independent opinion on its fairness, accuracy, or compliance with specified criteria.

Attestation engagements differ from audit engagements in that they provide a lower level of assurance than an audit. This is because attestation engagements are typically performed on a limited scope of information and do not require the same level of testing as an audit.

The Role of the CPA Practitioner

The CPA practitioner has the responsibility to plan, perform, and report on the results of an attestation engagement in accordance with professional standards.

The CPA practitioner must be independent and objective in order to provide an unbiased opinion on the information being attested to.

Planning the Engagement

The CPA practitioner should consider the following factors when planning an attestation engagement:

- The nature and complexity of the information being attested to

- The level of assurance required

- The resources available to the CPA practitioner

The CPA practitioner should also develop a written engagement letter that Artikels the terms of the engagement, including the scope of the engagement, the level of assurance to be provided, and the responsibilities of the CPA practitioner and the client.

Conducting the Engagement, In an attestation engagement a cpa practitioner is engaged to

The CPA practitioner should perform the following procedures during an attestation engagement:

- Obtain an understanding of the information being attested to

- Assess the risks of material misstatement

- Design and perform procedures to obtain sufficient appropriate evidence

- Evaluate the evidence obtained

The CPA practitioner should obtain sufficient appropriate evidence to support the opinion expressed in the attestation report.

Reporting on the Engagement

The CPA practitioner may issue different types of attestation reports, depending on the level of assurance provided.

The most common types of attestation reports are:

- Unqualified opinion

- Qualified opinion

- Adverse opinion

- Disclaimer of opinion

The attestation report should contain the following information:

- A statement of the level of assurance provided

- A description of the procedures performed

- A statement of the findings

- An opinion on the information being attested to

Helpful Answers

What is the purpose of an attestation engagement?

The purpose of an attestation engagement is to provide an opinion on the fairness of financial statements or other subject matter.

What is the difference between an attestation engagement and an audit engagement?

Attestation engagements provide a lower level of assurance than audit engagements.

What are the responsibilities of a CPA practitioner in an attestation engagement?

The CPA practitioner’s responsibilities include gathering evidence, assessing the reliability of the subject matter, and providing an opinion on the fairness of the subject matter.